Eeoc Complaint 2001

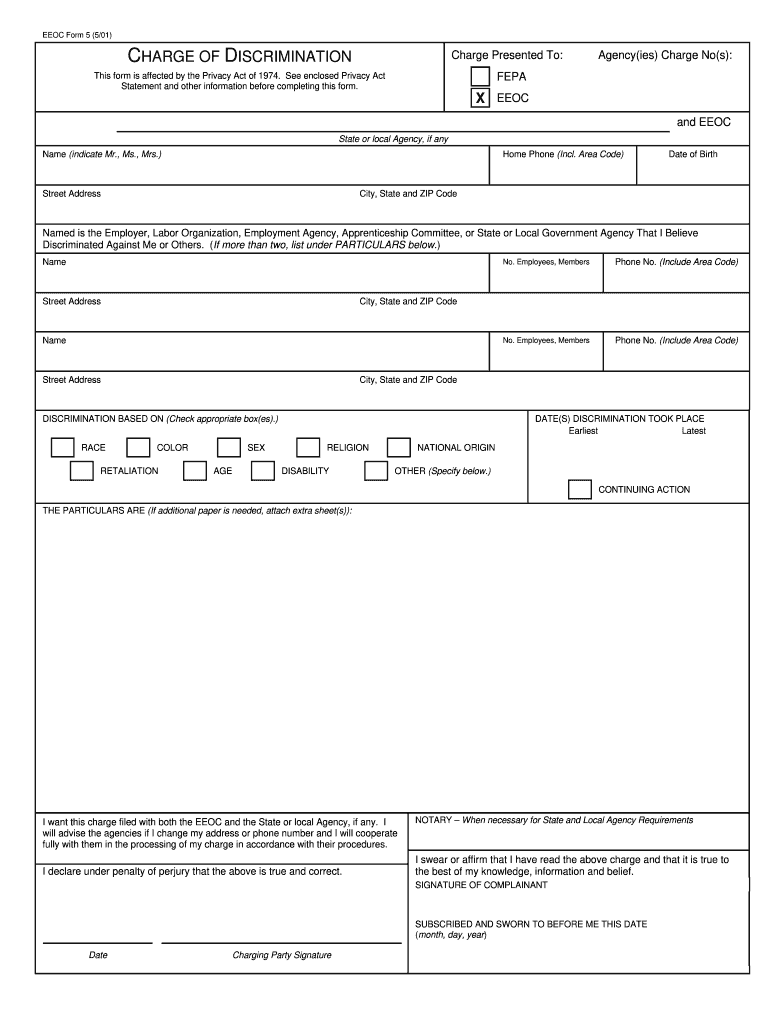

What is the EEOC Complaint?

The EEOC complaint is a formal document submitted to the U.S. Equal Employment Opportunity Commission (EEOC) to report discrimination in the workplace. This complaint can address various issues, including age, race, gender, disability, and retaliation. By filing an EEOC complaint, individuals seek to initiate an investigation into their claims and potentially pursue legal action if discrimination is confirmed. Understanding the nature of the complaint is crucial for individuals who believe they have been wronged in their employment settings.

Steps to Complete the EEOC Complaint

Completing the EEOC charge of discrimination form involves several important steps. Begin by gathering all relevant information regarding the discriminatory actions you experienced. This includes dates, names of individuals involved, and specific details about the incidents. Next, accurately fill out the EEOC charge form, ensuring that all sections are completed. It is essential to provide truthful information, as inaccuracies can lead to complications. After completing the form, review it for clarity and completeness before submitting it to the EEOC.

Legal Use of the EEOC Complaint

The EEOC complaint serves as a legal tool for individuals seeking justice against workplace discrimination. Filing this complaint is often a prerequisite for pursuing a lawsuit against an employer. The EEOC will investigate the claim and may facilitate a resolution through mediation or issue a right-to-sue letter, allowing the complainant to take further legal action. Understanding the legal implications of submitting an EEOC complaint is vital for individuals considering this route.

Required Documents

When filing an EEOC complaint, certain documents may be required to support your claim. These documents can include pay stubs, performance evaluations, emails, or any other records that substantiate your allegations of discrimination. It is advisable to keep copies of all submitted documents for your records. Having comprehensive documentation can significantly strengthen your case during the investigation process.

Form Submission Methods

The EEOC charge of discrimination form can be submitted through various methods, including online, by mail, or in person. Online submissions are often the most efficient, allowing for immediate confirmation of receipt. If submitting by mail, ensure that you send the form to the correct EEOC office and consider using a trackable mailing service. In-person submissions can be made at local EEOC offices, where you may also receive assistance in completing the form.

Filing Deadlines / Important Dates

Timeliness is crucial when filing an EEOC complaint. Generally, individuals must file their complaint within 180 days of the alleged discriminatory act. However, this deadline can extend to 300 days if the complaint is also covered by state or local anti-discrimination laws. Being aware of these deadlines is essential to ensure that your complaint is considered valid and that you retain your right to pursue further legal action.

Eligibility Criteria

To file an EEOC complaint, individuals must meet specific eligibility criteria. The complaint must involve a workplace issue related to discrimination based on race, color, religion, sex, national origin, age, disability, or genetic information. Additionally, the individual must be an employee or job applicant of a covered employer, which typically includes businesses with 15 or more employees. Understanding these criteria is essential before initiating the complaint process.

Quick guide on how to complete eeoc charge form

A Simple Guide on How to Complete Eeoc Complaint

Filling out digital forms has demonstrated greater efficiency and security compared to conventional paper and pen methods. Unlike when you manually write on paper, correcting a typo or placing information in the wrong field is straightforward. Such errors can be a signNow disadvantage when you are preparing applications and requests. Consider leveraging airSlate SignNow for completing your Eeoc Complaint. Our robust, user-friendly, and compliant eSignature solution will simplify this process for you.

Follow our instructions on how to swiftly fill out and sign your Eeoc Complaint using airSlate SignNow:

- Confirm the purpose of your chosen document to ensure it meets your needs, and click Get Form if it does.

- Find your template uploaded into our editor and explore what our tool provides for form modification.

- Fill in the empty fields with your information and tick the boxes using Check or Cross options.

- Insert Text boxes, replace existing content, and include Images wherever necessary.

- Utilize the Highlight feature to underscore what you want to spotlight, and conceal irrelevant information from your recipient with the Blackout tool.

- In the right-side panel, add additional fillable fields designated for specific parties if needed.

- Secure your document with watermarks or establish a password upon completing the edits.

- Insert Date, click Sign → Add signature and choose your signing method.

- Draw, type, upload, or craft your legally binding eSignature with a QR code or by using your device's camera.

- Review your responses and click Done to finalize the edits and move onto file sharing.

Utilize airSlate SignNow to create your Eeoc Complaint and handle other professional fillable templates securely and efficiently. Register now!

Create this form in 5 minutes or less

Find and fill out the correct eeoc charge form

FAQs

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

Why does HR block charge me extra to fill out certain forms?

H&R Block is a business. Basic Forms are easy, require less time and less expertice. Thus, they cost less. As forms increase in complexity, they require a tax pro with more education (thus more expertise) to complete, thus a higher cost. Several forms require more “Due Diligence”, meaning the tax pro must interview the client and determine if that tax credit/deduction meets the IRS rules. Those form require a comprehensive understanding of the tax law and the ability to determine what is happening with the client.Tax laws are very complex. There are volumes of books filled with tax law, court rulings and classes on handling certain transactions and situations in life. How could they all be priced the same?

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Is it normal nowadays for U.S. physicians to charge $100+ to fill out a 2-page form for a patient?

Medicaid patients would never be expected to pay their own bills. That defeats the purpose of providing this program as a resource to the aid of those who are below the poverty level. Legally, if you signed paperwork to the effect that you agree to pay whatever your insurance won't, there may be an issue.The larger question aside, technically, the professionally can set his fees at whatever level the market will allow. His time spent to complete your form would have been otherwise spent productively. The fact that he is the gatekeeper to your disability benefits should amount to some value with which you are able to accept rewarding him (or her).The doctor’s office needs to find a billable reason to submit (or re-submit) the claim as part of your medical treatment to Medicaid. It is absolutely a normal responsibility of their billing office to find a way to get insurance to reimburse. The failure is theirs, and turning the bill over to you would be ridiculous.If they accept Medicaid to begin with, they have to deal with the government’s complex processes to get paid. Generally, when a claim is denied a new reason to justify the doctor patient interaction will be necessary. I would guess “encounter for administrative reason” was sent. It is often too vague to justify payment. They may need to include the diagnosis behind your medical disability. If they have seen you before, and medical claims have bern accepted on those visits, then a resubmission for timely follow-up on those conditions could be justifued as reason for payment. The fact is, Medicaid is in a huge free-fall and payments are coming much more slowly since the new year. $800 billion is planned to be cut and possibly $600 billion on top of that. When we call their phone line for assistance, wait times are over two hours, if any one even answers. Expect less offices to accept new Medicaid, and many will be dismissing their Medicaid clients. If the office closes due to poor financial decisions, they can be of no service to anyone.Sister, things are rough all over.

Create this form in 5 minutes!

How to create an eSignature for the eeoc charge form

How to generate an eSignature for the Eeoc Charge Form online

How to generate an electronic signature for the Eeoc Charge Form in Chrome

How to make an eSignature for signing the Eeoc Charge Form in Gmail

How to generate an electronic signature for the Eeoc Charge Form straight from your mobile device

How to generate an electronic signature for the Eeoc Charge Form on iOS

How to make an electronic signature for the Eeoc Charge Form on Android

People also ask

-

What is EEO 5 reporting?

The Elementary - Secondary Staff Information Report (EEO-5), EEOC Form 168A, also referred to as the EEO-5 Report, is a mandatory biennial data collection that requires all public elementary and secondary school systems and districts with 100 or more employees to submit demographic workforce data, including data by ...

-

What qualifies as an EEOC complaint?

You can file a formal job discrimination complaint with the EEOC whenever you believe you are: Being treated unfairly on the job because of your race, color, religion, sex (including pregnancy, gender identity, and sexual orientation), national origin, disability, age (age 40 or older) or genetic information; or.

-

Does an EEOC charge have to be signNowd?

Verification of EEOC Charge That submission must be “in writing under oath or affirmation.” EEOC regulations require that the written charge be signed and verified, which means sworn under penalty of perjury or affirmed before a notary public, an EEOC representative or another person authorized to administer oaths.

-

What are the chances of winning an EEOC case?

FAQs. Q: What Are the Chances of Winning an EEOC Case? A: The EEOC has a very high success rate when it comes to court decisions, signNowing favorable outcomes in nearly 96% of all district court cases stemming from EEOC complaints.

-

What is an EEOC charge file?

A charge of discrimination is a signed statement asserting that an organization engaged in employment discrimination. It requests EEOC to take remedial action. The laws enforced by EEOC, except for the Equal Pay Act, require you to file a charge before you can file a lawsuit for unlawful discrimination.

-

What are examples of EEOC violations?

EEOC Cases Illustrate Examples of Unlawful Discrimination at Work Retaliatory Firing. One employer fired an administrative assistant because she participated in an EEOC investigation. ... Racial Discrimination and Retaliation. ... Sexual and Racial Harassment.

-

What are examples of EEOC charges?

EEOC Cases Illustrate Examples of Unlawful Discrimination at Work Retaliatory Firing. One employer fired an administrative assistant because she participated in an EEOC investigation. ... Racial Discrimination and Retaliation. ... Sexual and Racial Harassment.

-

What is an EEOC form 5?

This form is used by individuals who believe that they are discriminated at their work place due to their race, sex, religion, sexual orientation or other factors. The charge of discrimination is the first step before filing a job discrimination lawsuit.

Get more for Eeoc Complaint

- Demolition contractor package virginia form

- Security contractor package virginia form

- Insulation contractor package virginia form

- Paving contractor package virginia form

- Site work contractor package virginia form

- Siding contractor package virginia form

- Refrigeration contractor package virginia form

- Drainage contractor package virginia form

Find out other Eeoc Complaint

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement